AUDIT REPRESENTATION. Should you request Gurin & Gurin, P.C. to represent you for an audit, additional fees will apply. A retainer is required, and a Power of Attorney will need to be signed before any work will commence.

RECORD RETENTION. Gurin & Gurin, P.C. keeps copies of individual records for a minimum of SIX (6) years. Subsequently, all applicable records are shredded or return (upon request only).

ADDITIONAL FEES. Additional fees will be assessed when, through no fault of our own, your tax return needs to be reprocessed due to additional or incorrect information ($35.00), or you request an additional hard copy of your return ($20 per return).

DISCOUNTS. Gurin & Gurin, P.C. offers the following discounts:

- Drop-off/Mail-in. Receive 5% off when you drop off or mail in your tax information (10% for seniors age 65+). Information must be received no later than 03/21/25 to qualify & cannot be combined with any other offer, special or discount.

- Extension. Receive 10% off if you have your return prepared after 04/15/25. Information must be recieved no later than 06/27/25 to qualify & cannot be combined with any other offer, special or discount.

APPOINTMENTS. Please call ahead if you are unable to keep your scheduled appointment.

REFERRALS. We encourage and continue to accept your referrals as it is the best compliment we can receive. All preparers are well-trained in all areas of tax and accounting and stay apprised of the continuous tax and accounting changes.

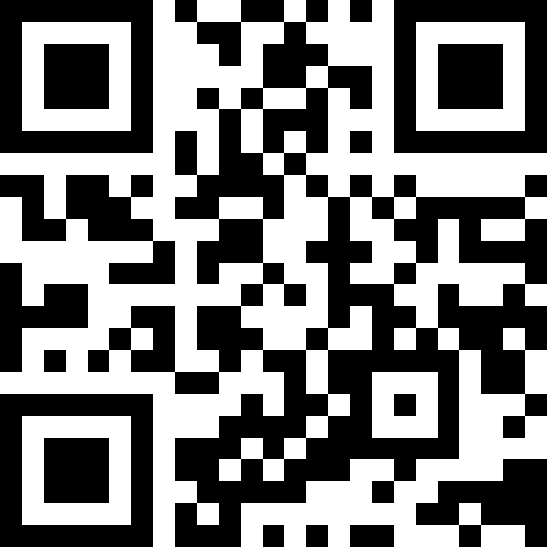

THIRD PARTY INFORMATION REQUESTS. By law, we are not authorized to disclosed your tax return information to third parties without your SIGNED & WRITTEN consent. The release of information form is available here and can also be downloaded from our home page.

gurin-gurin.com

gurin-gurin.com